While providing ERP services to companies in the United States, we often hear the desire to simplify routine work in order to reduce costs and concentrate more resources on core operations.

Also, there tends to be more variance in skill levels, awareness of responsibility, and work accuracy among the workers, coupled with higher turnover rates. As of such, there is an increasing desire to offload work to systems and dedicated services to achieve more consistency.

In the past, when attempting to perform such improvement, it was common to build a completely original system based on specific requirements, or to customize the ERP at a large cost.

However, these days, a method of utilizing external services and linking them to the core system (ERP, etc.) is becoming popular.

In this article, we will explore some cloud-based external services that are most commonly used:

SAP Concur

Expense reimbursement service

Application and processing for business trips are very labor-intensive tasks for the person traveling, approvers and clearing departments.

In past conventional procedures, application and approval were done in writing, expense management in Excel, and collection of paper receipts required manual attention. But nowadays, many companies utilize external services that drastically reduce work time while going paperless. SAP Concur provides some of the following:

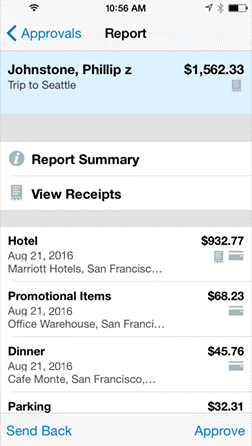

- Business trip application and approval through mobile device

- Mileage calculation using Google map

- Booking flights and hotels through Concur website

- Reading receipt using OCR

In addition, it is possible to set internal regulations such as the upper limit to hotel fee and to alert both the applicant and the administrator if the application exceeds the cap. All of this information, including the approval history, will remain as a log, allowing you to save labor during audits.

On a different note, WorkPlace of Paramount Technologies is another great service, offering not only application and approval of expenses for travel, but also general workflow functions such as purchase requests for goods and general approval.

Since these services can be linked with ERPs such as Microsoft Dynamic 365 and Dynamics GP, information such as approved expenses and purchased products can be easily fed directly to the core system.

Tax rate calculation service (Avalara)

In the US you can have different sales tax rates in each state, counties and cities. In addition, the tax rate may be set in detail for various service and products too.

In general accounting systems and ERPs, you can manually enter the tax rate when creating customer invoices, making tax rate master and reflecting it automatically to the invoice, but the following problems should be considered:

- Erroneous input of tax rate and amount is likely to occur in manual processes.

- You must know the tax rate for each state, county, city, service, and product.

- You must check and manually update tax rates that changes frequently.

In order to assess such challenges, there are several services in the US that act as a tax calculator, but among them, Avalara is a company that is growing rapidly.

Avalara is a relatively young company that was founded in 2004, but it has an interface (API) that can link with more than 700 business systems (accounting system, POS system, e-commerce system, etc.) including ERPs such as Microsoft Dynamics 365 and Dynamics GP.

When you generate an invoice with an accounting system or ERP, if the Ship To (shipping address) and Service / Product information are linked to Avalara’s cloud service, the tax rate that is automatically calculated by Avalara will be reflected to the invoice.

As Avalara is a service specialized for tax rates, constant updates for tax rate changes in each state, county, city, service and product are reflected to the service.

In addition, as tax calculation is a very sensitive operation that can result in a penalty in case of mistakes, it is also beneficial from risk management standpoint to use specialized external services such as Avalara rather than trying to handle on your own.

The two cloud-based services mentioned above here are just a couple of examples, but they reflect a major trend that Instead of building a system specialized for the company and “holding it”, businesses are shifting their operations to incorporate market trends and “using” cloud-based services in the right places.