Organizations need to predict future financial outcomes with precision to make informed decisions and stay ahead of the competition. But challenges like market uncertainty, data quality, and the complexity of operations can make it difficult. Changes in regulations, unexpected events, and technology-related challenges also impact forecasting accuracy.

One of the key tools helping businesses improve their financial forecasting is ERP accounting systems. These systems not only streamline financial processes but also provide advanced tools for analysis and reporting, enabling organizations to make more accurate predictions. This blog explores the role of ERP accounting systems in enhancing financial forecasting, the benefits they offer, showcasing how other businesses successfully implemented ERP for their accounting needs.

Understanding Financial Forecasting in Business

Financial forecasting is the process of estimating future financial outcomes for a business based on historical data, economic trends, and other relevant factors. It involves predicting revenues, expenses, profits, and cash flow to help businesses plan and make informed decisions.

Businesses face several challenges in achieving accurate financial forecasting, including:

- Market Volatility: Fluctuations in market conditions, such as changes in consumer behavior, competitive landscape, or economic factors, can make it difficult to predict future financial outcomes.

- Data Accuracy: Ensuring the accuracy and completeness of historical data used for forecasting is crucial. Inaccurate or incomplete data can lead to unreliable forecasts.

- Complexity of Operations: Businesses with complex operations, multiple revenue streams, or global presence may find it challenging to integrate and analyze data from different sources for forecasting.

- Uncertain Events: Unforeseen events such as natural disasters, political instability, or pandemics can significantly impact financial forecasts, making them less reliable.

- Lack of Resources: Limited resources, such as budget constraints or shortage of skilled personnel, can hinder the ability to conduct thorough financial analysis and forecasting.

- Technological Limitations: Outdated or inadequate technology infrastructure may restrict access to real-time data and advanced forecasting tools, impacting the accuracy of forecasts.

- Regulatory Changes: Changes in financial regulations or accounting standards can affect how businesses report and forecast financial data, adding complexity to the forecasting process.

The Role of ERP Accounting Systems in Financial Management

ERP accounting systems, often referred to as ERP finance, encompass the financial management functionalities within an ERP system. These systems integrate diverse financial and accounting processes within an organization, serving as a centralized hub for managing financial data, transactions, and reporting. This integration streamlines operations and enhances overall efficiency in financial management, making them an exceptional choice for business accounting software.

The role of ERP accounting systems in financial management can be summarized as follows:

- Centralized Financial Data: ERP systems consolidate financial data from various departments and locations into a single database, providing a unified view of the organization’s financial health.

- Automated Financial Processes: ERP systems automate repetitive accounting tasks such as data entry, reconciliation, and reporting, reducing manual errors and saving time.

- Financial Planning and Budgeting: ERP systems enable organizations to create and manage budgets, forecast financial performance, and track actual results against budgeted figures.

- Compliance and Risk Management: ERP systems help ensure compliance with financial regulations and internal policies by providing standardized processes and controls.

- Improved Reporting and Analysis: ERP systems offer robust reporting and analysis tools, allowing organizations to generate financial reports, analyze data, and make informed decisions.

- Enhanced Financial Visibility: ERP systems provide real-time access to financial data, enabling stakeholders to monitor financial performance and make timely adjustments.

- Integration with Other Business Processes: ERP systems integrate with other business functions such as inventory management, procurement, and sales, providing a holistic view of the organization’s operations.

Benefits of ERP in Financial Forecasting

ERP systems offer several benefits for financial forecasting, including the integration of financial data, automation of processes, and real-time data access. These benefits can help organizations improve the accuracy and reliability of their financial forecasts, leading to better decision-making and overall business performance.

Integration of Financial Data

ERP systems play a crucial role in financial forecasting by integrating data from various departments such as sales, marketing, and operations. This integration provides a comprehensive view of the organization’s financial health, allowing for more accurate and reliable forecasts. By consolidating data into a single database, ERP systems eliminate data silos and ensure that decision-makers have access to up-to-date information for forecasting purposes.

Automation of Processes

One of the key benefits of ERP systems in financial forecasting is the automation of repetitive tasks. These systems can automatically collect, process, and analyze financial data, saving time and reducing the risk of errors. By automating tasks such as data entry, reconciliation, and reporting, ERP systems allow finance teams to focus on more strategic activities, such as analyzing trends and making recommendations based on forecasted data.

Real-time Data Access

ERP systems provide real-time access to financial data, enabling organizations to make quick adjustments to forecasts based on current information. This real-time data access is crucial for responding to changing market conditions, unexpected events, or new opportunities. By accessing up-to-date information, organizations can make more informed decisions and improve the accuracy of their financial forecasts.

Enhanced Reporting and Analytics

Enhanced reporting and analytics capabilities provided by ERP systems offer organizations valuable tools for analyzing financial data, gaining insights, and making informed decisions. By leveraging advanced reporting and predictive analytics, organizations can improve the accuracy and effectiveness of their financial forecasting, leading to better business outcomes.

Advanced Reporting Capabilities

ERP systems provide advanced reporting tools that enable organizations to generate a wide range of financial reports, including balance sheets, income statements, and cash flow statements. These tools allow for in-depth analysis of financial data, helping businesses identify trends, track performance, and make informed decisions. Advanced reporting capabilities also enable organizations to create customized reports tailored to their specific needs, providing greater flexibility and insights into their financial performance.

Predictive Analytics

One of the key features of ERP systems is their ability to incorporate predictive analytics into financial forecasting. Predictive analytics uses historical data, statistical algorithms, and machine learning techniques to forecast future trends and outcomes. By analyzing past performance and identifying patterns, ERP systems can predict future financial results with greater accuracy. This enables organizations to anticipate changes in the market, identify potential risks and opportunities, and make proactive decisions to optimize their financial performance.

Streamlining ERP Accounting with Microsoft Dynamics 365

Microsoft Dynamics 365 offers a comprehensive suite of ERP accounting solutions with several features and functionalities that can help businesses with financial forecasting. Here are several key features through which Dynamics 365 can enhance ERP accounting:

Integration of Financial Data: Dynamics 365 integrates financial data from various sources and departments, providing a unified view of the organization’s financial health. This integration eliminates data silos and allows for more accurate forecasting by ensuring that all relevant data is considered.

Automated Financial Processes: Dynamics 365 automates repetitive accounting tasks such as data entry, reconciliation, and reporting, reducing manual errors and saving time. This automation improves efficiency and allows finance teams to focus on more strategic activities.

Real-time Financial Reporting: Dynamics 365 provides real-time access to financial data, enabling organizations to generate financial reports quickly and accurately. Real-time reporting allows for more agile forecasting, helping businesses respond to changes in the market more effectively.

Advanced Analytics: Dynamics 365 offers advanced analytics capabilities, including predictive analytics, that help organizations forecast financial outcomes with greater accuracy. By analyzing historical data and identifying patterns, predictive analytics can help businesses anticipate changes in the market and make proactive decisions.

Compliance and Security: Dynamics 365 helps ensure compliance with financial regulations and internal policies by providing standardized processes and controls. The platform also offers robust security features to protect financial data from unauthorized access.

Scalability and Flexibility: Dynamics 365 is highly scalable and can be customized to meet the unique needs of businesses of all sizes. Whether a business is expanding or changing its operations, Dynamics 365 can adapt to accommodate these changes.

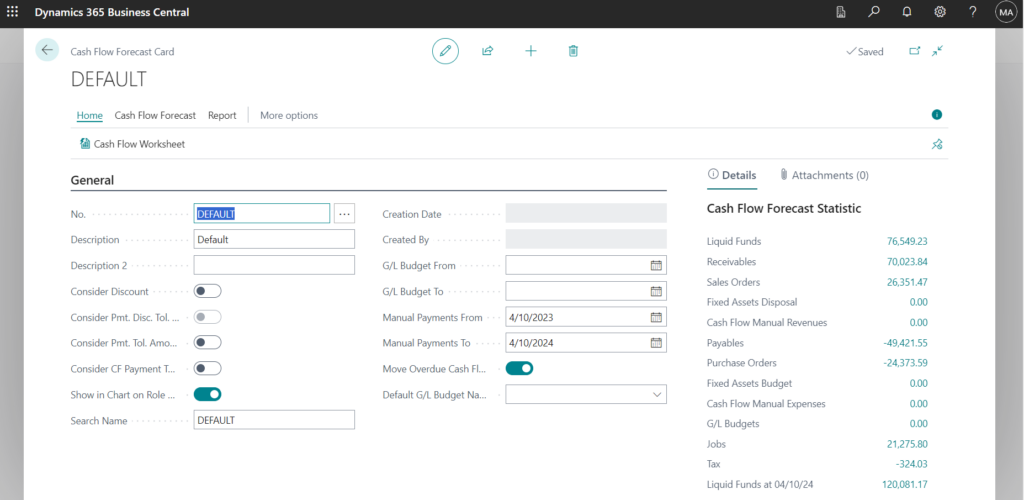

Learn more: Forecast your cash flow in Dynamics 365 Business Central

Comparing QuickBooks and Dynamics 365 for Financial Forecasting and Management

QuickBooks and Dynamics 365 are both popular choices for financial management, including financial forecasting. Here’s a comparison of the two:

Scope and Scalability: Dynamics 365 is more robust and scalable, suitable for medium to large enterprises with complex financial needs. QuickBooks, on the other hand, is more suitable for small to medium-sized businesses with simpler financial requirements.

Features and Functionality: Dynamics 365 offers a wide range of features for financial forecasting and management, including advanced reporting and analytics, budgeting, and multi-currency support. QuickBooks also offers these features but with a more simplified approach, which may be sufficient for smaller businesses.

Integration and Customization: Dynamics 365 offers better integration capabilities, allowing for seamless integration with other Microsoft products and third-party applications. QuickBooks also offers integration options but may be more limited compared to Dynamics 365. Dynamics 365 also offers more customization options to tailor the system to specific business needs.

Cost: QuickBooks is generally more cost-effective, especially for small businesses, with a lower initial investment and simpler pricing structure. Dynamics 365, being more robust, tends to have higher upfront costs and ongoing expenses, especially for customization and maintenance.

User Experience: QuickBooks is known for its user-friendly interface and ease of use, making it ideal for businesses without dedicated finance teams. Dynamics 365, while more powerful, may have a steeper learning curve and require more training for users.

Read more: Dynamics 365 Business Central vs. QuickBooks – Find Out What Works For Your Business

Choosing the Right Financial Management Solution: QuickBooks vs. Dynamics 365

Choosing between QuickBooks and Dynamics 365 depends on your business’s size, financial management needs, and growth plans. QuickBooks is ideal for small to medium-sized businesses with straightforward financial requirements and budget limitations. On the other hand, Dynamics 365 is better suited for medium to large enterprises that need robust financial tools, scalability, and customization options to meet complex financial demands.

Calsoft Systems offer a CloudShift migration package for QuickBooks to Dynamics 365 Business Central. This package is designed for customers who have outgrown QuickBooks and are looking to migrate their data to the cloud, benefiting from Business Central’s elastic growth capabilities.

Learn more: Upgrade from QuickBooks to Dynamics 365

Case Studies: Successful ERP Accounting Implementation in Businesses

Implementing an ERP accounting system is a significant undertaking for any business, regardless of its size. It involves integrating various functions, processes, and departments into a unified system to streamline operations and improve efficiency.

In these case studies, we summarize the successful implementation of ERP accounting systems in businesses of different sizes and industries. These case studies provide valuable insights into the challenges faced, the strategies employed, and the outcomes achieved, offering a roadmap for other businesses considering similar implementations.

Food manufacturer upgrade from QuickBooks to Dynamics NAV

The case study outlines a successful migration from QuickBooks to Dynamics NAV for a food manufacturing facility. The company faced challenges with QuickBooks’ limited capabilities and sought a more robust solution to manage their complex operations. With Calsoft’s expertise, the migration was seamless, allowing the facility to streamline processes, improve inventory management, and gain real-time visibility into their operations. The new system also enabled better financial reporting and compliance with industry regulations.

Read the full case study: Quickbooks Upgrade to Dynamics NAV for Food Manufacturing Facility

Streamlining operations in oil & gas manufacturing

The case study showcases how Calsoft helped a leading oil and gas company in the discrete manufacturing sector to optimize their operations using Microsoft Dynamics 365 Finance and Operations. The company faced challenges with their legacy systems, including manual processes, lack of real-time visibility, and inefficient reporting. Calsoft implemented Dynamics 365 Finance and Operations to streamline processes, automate workflows, and improve visibility across the organization. As a result, the company achieved significant improvements in efficiency, accuracy, and decision-making. They experienced reduced operational costs, improved inventory management, and enhanced customer satisfaction.

Read the full case study: Oil & Gas Discrete Manufacturer Implements Dynamics 365

Consolidating multiple systems for efficiency with Dynamics 365

An IT company reliant on QuickBooks for its accounting needs found itself outgrowing the software due to its rapid expansion and evolving business requirements. With a history of acquisitions and mergers, the company found itself burdened with multiple internal systems that operated in isolation. These included QuickBooks for accounting, Salesforce for service operations, Bloomberg for fixed asset assessment, Paylocity for payroll management, and Expensify for expense reimbursement. The lack of integration among these systems posed a significant challenge. To address this challenge, the IT company opted for a new ERP system and chose Dynamics 365 for its comprehensive features and compatibility with the company’s operations. By centralizing operations around Dynamics 365, they ultimately reduced the costs associated with managing multiple systems.

Read the full case study: Microsoft Dynamics 365 Finance & Operations for Information Services

Conclusion

ERP accounting systems play a crucial role in improving financial forecasting for businesses. By integrating financial data, automating processes, and providing real-time data access, these systems help organizations overcome challenges and make more informed decisions. Before implementing an ERP system for financial forecasting, it’s essential to consider factors such as current financial processes, scalability, compatibility, and user-friendliness. With the right ERP system in place, businesses can enhance their financial forecasting capabilities and drive better business outcomes.

Selecting the best accounting software depends on several factors, including your business’s size, industry, and specific needs. It is essential to carefully evaluate different options, considering factors such as features, scalability, user-friendliness, and cost, before making a decision.

Ready to explore how ERP accounting systems can take your financial forecasting to the next level?